Treasury and Trade Solutions

Modernise your forex and treasury management

Why do you need Treasury Optimization Service?

forex and treasury management, or cash management, is the process of gathering and supervising cash flows from a company's investing, operating, and financing activities. It is a crucial component of a company's capacity to maintain its financial stability.

The scope of Treasury Management are:

Multiple Options to optimize for treasury operations

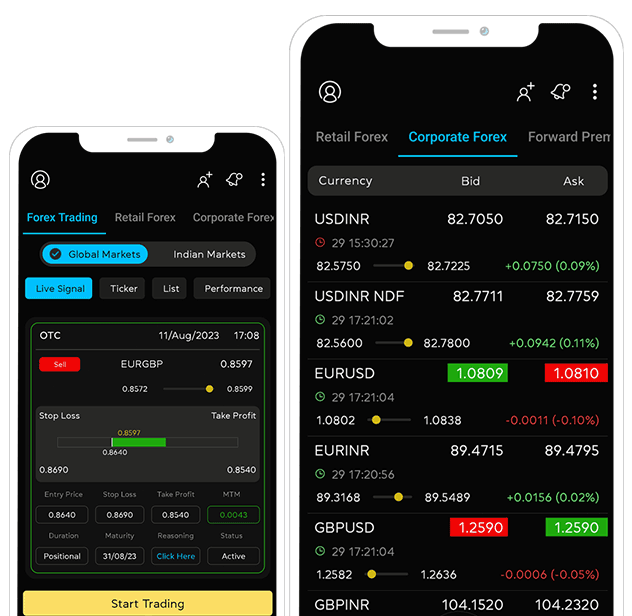

Forex Updates at Your Finger Tips, Stay Informed on Mobile App

Maximize savings by decoding finance costs across currencies

Elevate competitiveness and profits through optimized interest costs

Advantage of Treasury Optimization

At Myforexeye, our money management trading forex solutions aim to increase productivity in all treasury management areas, including strategic, transactional, and operational aspects.

Salient Features

Frequently Asked Questions

What Clients Says

We are associated with Myforexeye since 2014, they have been consulting us on our forex exposures and also reforming our hedging strategies. They have been looking after our treasury managemnt effeciently.

We have large dollar exports and managing forex risk is critical for our overall business profitability. We have collaborated with Myforexeye for forex market intelligence and insights to take prudent and informed decisions.

Myforexeye significantly reduced our trade finance costs to less than half of our previous bank payments, demonstrating their effectiveness in optimizing financial strategies and expenses.

We have been using the services of Myforexeye for the last 2 years. Their currency market predictions and analysis are mostly accurate.

My experience with them has been nothing short of exceptional. If you're in search of reliable and efficient forex services. Myforexeye is the perfect choice.

Case Studies

What We Have Achieved Till Now

Total Transactions

Transactions Processed

Total Savings

No. of Clients Served