Interest Cost Optimization

Reduce working capital finance cost with our domestic and global currency interest rate evaluation

An introduction to Interest cost optimization strategy

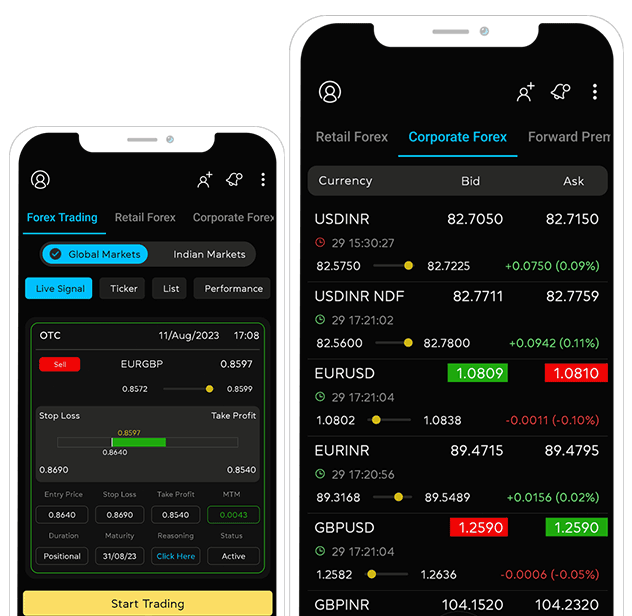

Myforexeye interest optimization offering is an innovative multi-dimensional, multi-currency liquidity solution that allows corporates’ to reduce cost of borrowing on their entire borrowings across geographies and usage.

Improved financial performance

Reducing interest costs can improve the company's bottom line and increase profitability.

Increased competitiveness

Lower interest costs can give the company a competitive advantage by reducing its overall cost structure.

Enhanced flexibility

By reducing interest costs, the company may have more financial flexibility to invest in growth opportunities or weather economic downturns.

Better risk management

Evaluating interest cost optimization strategies can help the company better manage its financial risks and reduce its exposure to interest rate fluctuations.

Improved decision making

A thorough evaluation of interest cost optimization strategies can provide valuable insights and inform better decision making.

From exporters to importers to domestic companies to multi-national companies and just about anything in between can use our services to objectively reduce borrowing costs on working capital finance and long term loans.

Multi-dimensional Strategy

Myforexeye supports customers across a wide range of industries, traders operating domestically or moving goods and capital across the globe and beyond. Explore more with our experts.

| Multi-Dimensional Product Evaluation Strategy | ||||

|---|---|---|---|---|

| Borrowing Options | Company | |||

| Debt Form | Product Type | Domestic Sales | Global Sales / Purchases | |

| Term Debt | Term Loans / ECB / FCTL | Local Currency | Multi-currency | |

| Working Capital | Pre-shipment | Local Currency | Multi-currency | |

| Post-shipment | Local Currency | Multi-currency | ||

| Fund-Based | Cash Credit/WCDL/FCNR (B) | EPC/PCFC, | ||

| Non-fund based | LCBD | Buyer's or Supplier's Credit | ||

Advantages of Interest cost optimization strategy

Salient Features

What Clients Says

We are regulated

SEBI Registration

Registered Investment Advisor(RIA)

NISM-202100075147

Sub-Broker

AP0091502703

CIN

U65910DL2014PTC320897

Ready to start making good choices?

Receive forex updates right in your mail box or Whatsapp

We use cookies to enhance your experience on our website. By continuing to use this site, you consent to the use of cookies in accordance with our Cookie Policy. You can manage and change your cookie settings at any time.