- Forex

- Trade Finance

- Trade Finance

- Import Finance

- Import Finance

- Buyer's Credit

- Supplier’s Credit

- Export Finance

- Retail Forex

- Export LC Discounting

- Export Factoring

- Solutions

- Publications

- Partnership

- Book a Demo

Multinational Companies (MNCs)

Expand Your Horizons With Our Expert Forex Solutions, Strategically Designed To Excel In Global Markets

Myforexeye for MNCs

International trade of goods and services play a crucial role for multinational firms. By engaging in this global exchange, MNCs aim to unlock new markets, broaden their customer base, and reduce dependence on a single market. To aid in these endeavours, Myforexeye has tailored services specifically designed to tackle all these challenges that MNCs encounter when dealing with forex.

Why Myforexeye

Expert Solutions For MNCs

Myforexeye Class Leading Services For Foreign Exchange and Risk Management

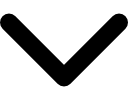

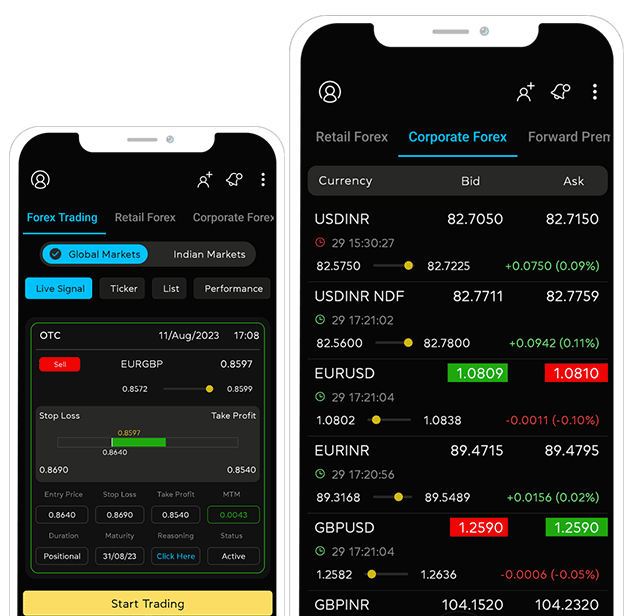

With our comprehensive mobile app, you can experience the power of having all of these services at your fingertips. Simplify your international payment related activities to save time and effort while increasing the potential of your business and trade.

Download our app and start enjoying the seamless forex trading experience today.

Our Services

If you are a Multi-National Corporation, Myforexeye is your strategic partner, offering expert forex solutions to optimize your international financial operations and boost your bottom line.

What Clients Says

Case Studies

What We Have Achieved Till Now

Total Transactions

USD Billion

Transactions Processed

USD million

Total Savings

No. of Clients Served

We are regulated

SEBI Registration

Registered Investment Advisor(RIA)

NISM-202100075147

Sub-Broker

AP0091502703

CIN

U65910DL2014PTC320897

Ready to start making good choices?

Receive forex updates right in your mail box or Whatsapp

We use cookies to enhance your experience on our website. By continuing to use this site, you consent to the use of cookies in accordance with our Cookie Policy. You can manage and change your cookie settings at any time.