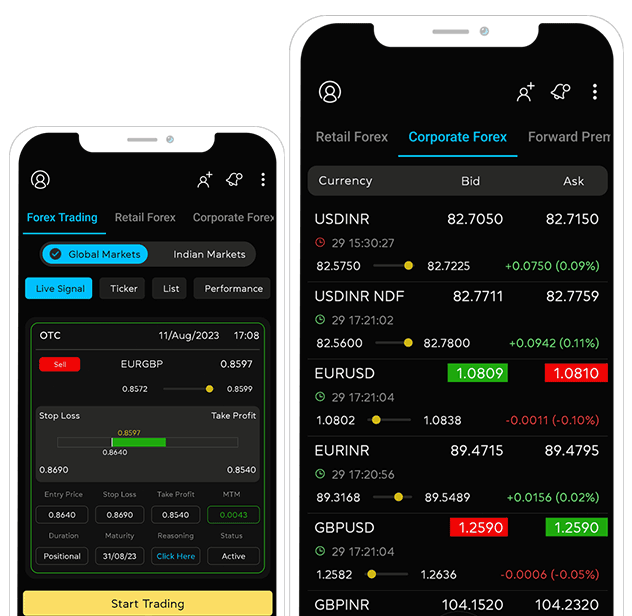

- Forex

- Trade Finance

- Trade Finance

- Import Finance

- Import Finance

- Buyer's Credit

- Supplier’s Credit

- Export Finance

- Retail Forex

- Export LC Discounting

- Export Factoring

- Solutions

- Publications

- Partnership

- Book a Demo

Date:

Recent Blog

Want to manage Forex?

Newsletter signup

Receive forex updates right in your mail box or Whatsapp

Similar Post

In the forex market, AI is revolutionizing the industry by providing traders with powerful tools and insights, enhancing their decision-making capabilities

We are regulated

SEBI Registration

Registered Investment Advisor(RIA)

NISM-202100075147

Sub-Broker

AP0091502703

CIN

U65910DL2014PTC320897

Ready to start making good choices?

Receive forex updates right in your mail box or Whatsapp

We use cookies to enhance your experience on our website. By continuing to use this site, you consent to the use of cookies in accordance with our Cookie Policy. You can manage and change your cookie settings at any time.