- Forex

- Trade Finance

- Trade Finance

- Import Finance

- Import Finance

- Buyer's Credit

- Supplier’s Credit

- Export Finance

- Retail Forex

- Export LC Discounting

- Export Factoring

- Solutions

- Publications

- Partnership

- Book a Demo

International trade and working capital finance

Trade finance services by Myforexeye are tailored to provide businesses with the necessary working capital to facilitate international trade transactions. Companies engaged in import and export activities often face the challenge of managing their cash flow effectively. With our expertise and innovative solutions, Myforexeye empowers enterprises to optimize their working capital and streamline their trade operations.

Endless Opportunities

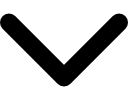

Forex Trading

Embark on your forex trading journey with Myforexeye, your trusted partner. Our online trading signals and expert guidance provide a seamless and profitable trading experience. Benefit from deep market insights and risk analysis.

Retail Forex

Discover the ultimate retail forex experience with Myforexeye. Enjoy seamless services such as currency exchange, money transfers, and forex cards - all in one place. Get unbeatable rates for buying forex and maximize returns when selling.

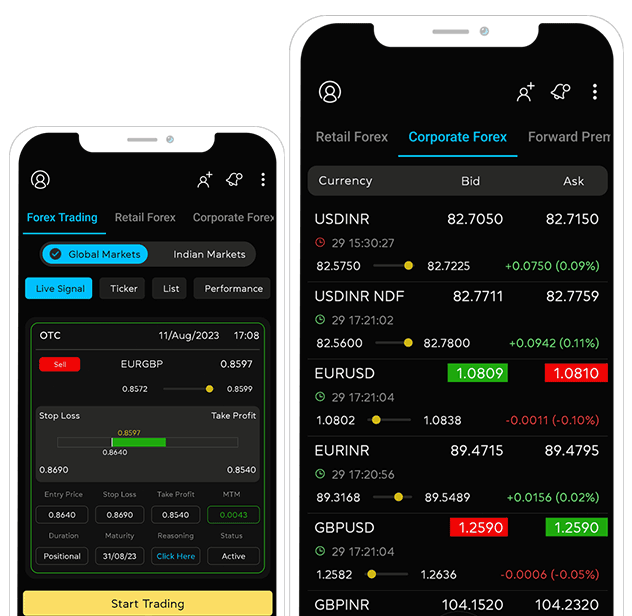

Corporate Forex

A revolutionary online platform for global business operations. With our platform, you can get unbeatable forex deals with top-notch rates. You can also empower growth, cut expenses, and secure transactions with personalized support.

Trade Finance

Trade finance services offer tailored solutions to enhance businesses engaged in internatio-nal trade. We understand the cash flow challenges of importers and exporters and provide innovative solutions to optimize working capital and streamline trade operations.

Forex Trading

Embark on your forex trading journey with Myforexeye, your trusted partner. Our online trading signals and expert guidance provide a seamless and profitable trading experience. Benefit from deep market insights and risk analysis.

Retail Forex

Discover the ultimate retail forex experience with Myforexeye. Enjoy seamless services such as currency exchange, money transfers, and forex cards - all in one place. Get unbeatable rates for buying forex and maximize returns when selling.

Corporate Forex

A revolutionary online platform for global business operations. With our platform, you can get unbeatable forex deals with top-notch rates. You can also empower growth, cut expenses, and secure transactions with personalized support.

Trade Finance

Trade finance services offer tailored solutions to enhance businesses engaged in internatio-nal trade. We understand the cash flow challenges of importers and exporters and provide innovative solutions to optimize working capital and streamline trade operations.

Trade Finance : All Services at Your Fingertips

Experience the power of having all these services at your fingertips with our comprehensive mobile app. Simplify your trade forex related activities, saving time and effort while focusing on maximizing your business.

Download our app and start enjoying the seamless forex experience today

Import Finance with Myforexeye

What do we offer?

Myforexeye understands the importance of prompt financing.With a focus on buyer's credit and supplier's credit, we offer a comprehensive range of services tailored to meet the financing needs of importers.We compare the lowest rates from over 100 + financial institutions within just one hour to ensure youreceive the most competitive offers.

Advantages :

Export Finance with Myforexeye

What do we offer?

Myforexeye specializes in providing comprehensive export finance solutions, catering to the diverse needs of exporters. With a focus on Export-LC-Discounting and Export-Factoring services, we offer a range of options to streamline your export finance operations.

Advantages :

We are regulated

SEBI Registration

Registered Investment Advisor(RIA)

NISM-202100075147

Sub-Broker

AP0091502703

CIN

U65910DL2014PTC320897

Ready to start making good choices?

Receive forex updates right in your mail box or Whatsapp

We use cookies to enhance your experience on our website. By continuing to use this site, you consent to the use of cookies in accordance with our Cookie Policy. You can manage and change your cookie settings at any time.