- Forex

- Trade Finance

- Trade Finance

- Import Finance

- Import Finance

- Buyer's Credit

- Supplier’s Credit

- Export Finance

- Retail Forex

- Export LC Discounting

- Export Factoring

- Solutions

- Publications

- Partnership

- Book a Demo

Stop paying excessive commission to exchange your currency

Access real-time forex rates

Why do we need forex rates services?

Many forex users lose a lot of money to bank or intermediaries who charge high conversion fees. The rates offered by banks are not clear. So, user should watch out for hidden costs.

Myforexeye’s forex rates services help you save a lot of money on your transactions.

Multiple Options to reduce forex conversion costs

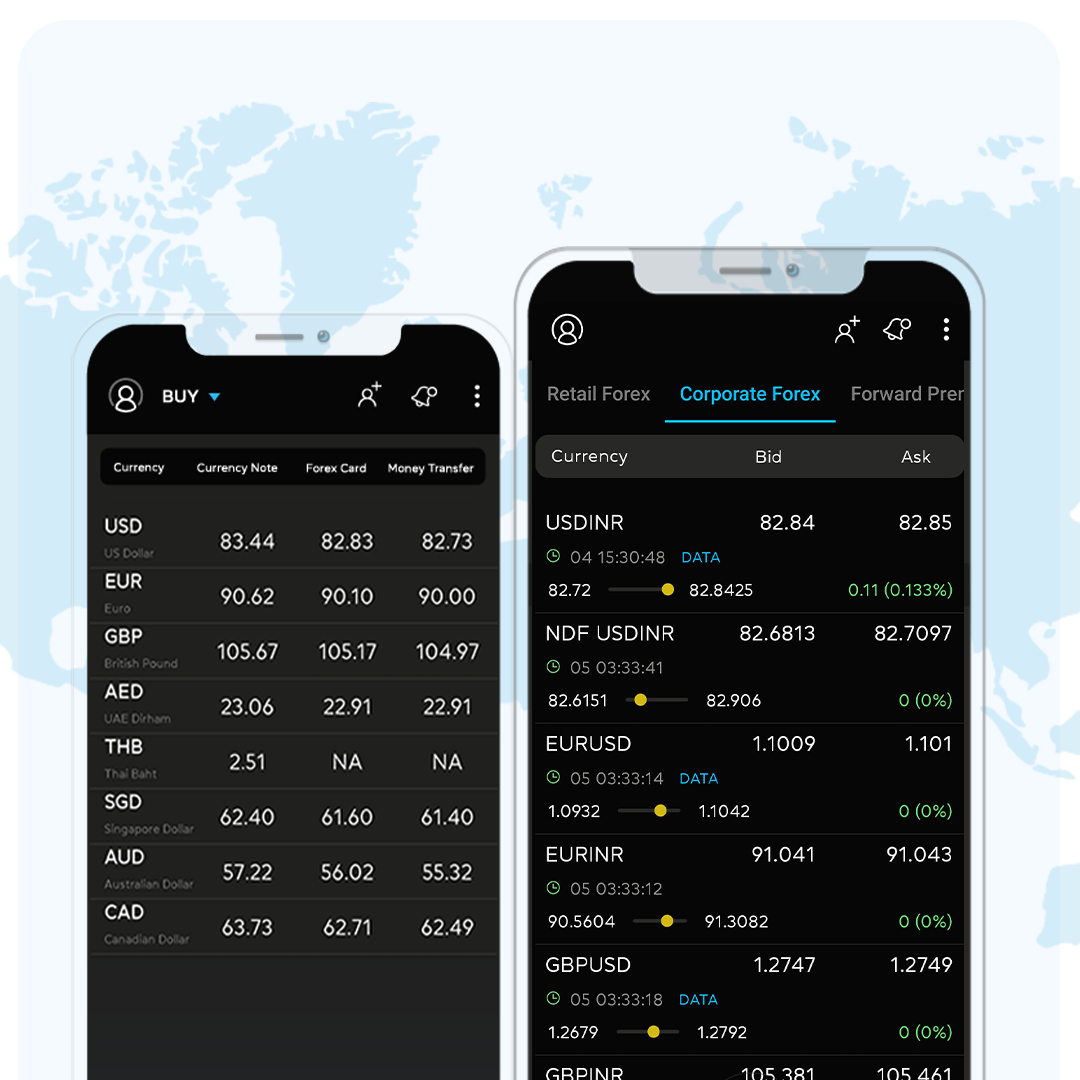

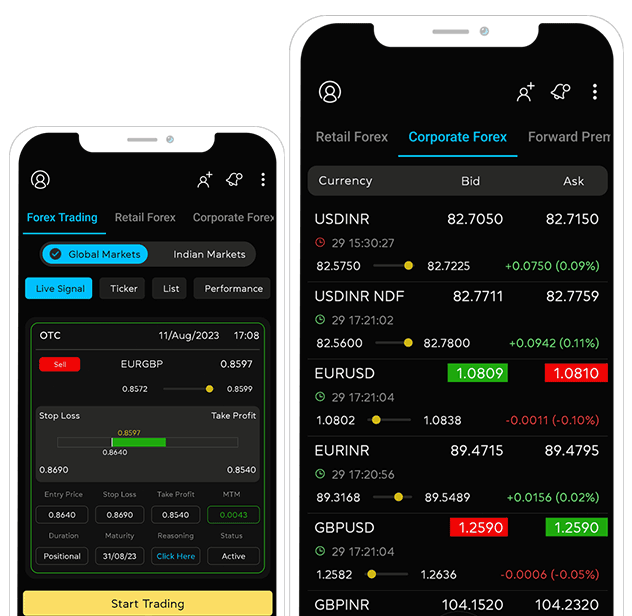

Get real time currency rates, low margins, fast execution And tight margins on all transactions on your mobile.

Outsource Forex Rate Negotiations To professionals to save on Forex Remittance

Forex on your mind? Get unbiased expert opinion on anything around forex. Get surprised!

Check Real-Time Forex Rates To Compare Bank Rates on Mobile App

Advantages of Rates on Myforexeye Mobile App

Salient Features

What Clients Says

Case Studies

We are regulated

SEBI Registration

Registered Investment Advisor(RIA)

NISM-202100075147

Sub-Broker

AP0091502703

CIN

U65910DL2014PTC320897

Ready to start making good choices?

Receive forex updates right in your mail box or Whatsapp

We use cookies to enhance your experience on our website. By continuing to use this site, you consent to the use of cookies in accordance with our Cookie Policy. You can manage and change your cookie settings at any time.