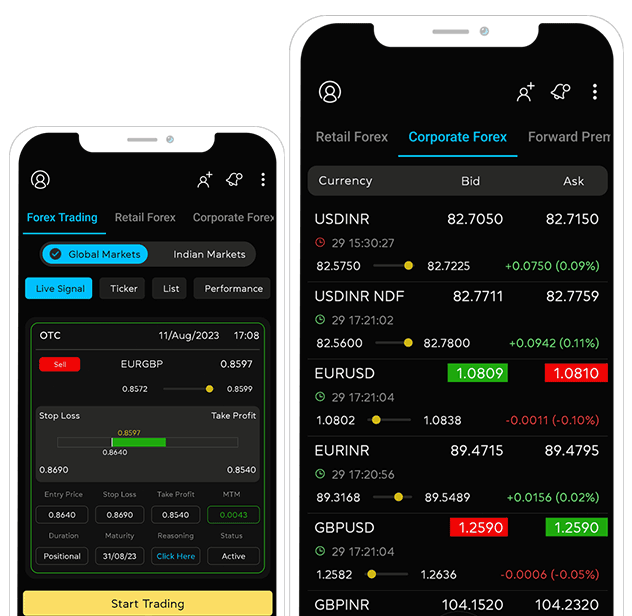

- Forex

- Trade Finance

- Trade Finance

- Import Finance

- Import Finance

- Buyer's Credit

- Supplier’s Credit

- Export Finance

- Retail Forex

- Export LC Discounting

- Export Factoring

- Solutions

- Publications

- Partnership

- Book a Demo

Glossary

A

ADX

Advance directional movement index. It’s a technical indicator designed by Welles Wilder to determine the presence of price trend. A reading above 25 indicates the presence of a trend. Buy/sell signals are provided by the crossing of +di and -di.

AMERICAN OPTION

An option contract that can be exercised on or before the expiry date.

APPRECIATION

A product is said to ‘appreciate’ when it strengthens in price in response to market demand.

ARBITRAGE

The simultaneous purchase or sale of a financial product in order to take advantage of small price differentials between markets.

ASCENDING TREND CHANNEL

A technical analysis price pattern, where price action is contained within two upward sloping parallel lines. The basic line is drawn through the bottoms, whereas the return line is drawn through the tops.

ASK (OFFER) PRICE

The price at which the market is prepared to sell a product. Prices are quoted two-way as bid/ask. The ask price is also known as the offer.

In fx trading, the ask represents the price at which a trader can buy the base currency, shown to the left in a currency pair. For example, in the quote USD/CHF 1.4527/32, the base currency is USD, and the ask price is 1.4532, meaning you can buy one us dollar for 1.4532 swiss francs.

In cfd trading, the ask also represents the price at which a trader can buy the product.

AT-THE-MONEY OPTION

An option whose strike price is equal to the current market price of the underlying, either at the money spot or at-the-money-forward.

AUTHORIZED FOREX DEALER

Any type of financial institution that has received authorization from a relevant regulatory body to act as a dealer involved with the trading of foreign currencies. Dealing with authorized forex dealers ensure that your transactions are being executed in a legal and just way.

B

BALANCE OF TRADE

The value of a country’s exports minus its imports.

BAR CHART

A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar.

BARRIER LEVEL

A certain price of great importance included in the structure of a barrier option. If a barrier level price is reached, the terms of a specific barrier option call for a series of events to occur.

BARRIER OPTION

Any number of different option structures (such as knock-in, knock-out, no touch, double-no-touch-dnt) that attaches great importance to a specific price trading. In a no-touch barrier, a large defined payout is awarded to the buyer of the option by the seller if the strike price is not ‘touched’ before expiry. This creates an incentive for the option seller to drive prices through the strike level and creates an incentive for the option buyer to defend the strike level.

BASE CURRENCY

The first currency in a currency pair. It shows how much the base currency is worth as measured against the second currency. For example, if the USD/CHF (u.s. Dollar/swiss franc) rate equals 1.6215, then one USD is worth CHF 1.6215. In the forex market, the us dollar is normally considered the base currency for quotes, meaning that quotes are expressed as a unit of $1 USD per the other currency quoted in the pair. The primary exceptions to this rule are the British pound, the EURO and the australian dollar.

BASE RATE

The lending rate of the central bank of a given country.

BASING

A chart pattern used in technical analysis that shows when demand and supply of a product are almost equal. It results in a narrow trading range and the merging of support and resistance levels.

BASIS POINT

A unit of measurement used to describe the minimum change in the price of a product.

BEARISH/BEAR MARKET

Negative for price direction; favoring a declining market. For example, “we are bearish EUR/USD” means that we think the EURO will weaken against the dollar.

BEAR MARKET

When the prices of certain financial instruments, or markets are declining.

BEARS

Traders who expect prices to decline and may be holding short positions.

BID/ASK SPREAD

The difference between the bid and the Ask (offer) price.

BID PRICE

The price at which the market is prepared to buy a product. Prices are quoted two-way as bid/ask. In fx trading, the bid represents the price at which a trader can sell the base currency, shown to the left in a currency pair. For example, in the quote USD/CHF 1.4527/32, the base currency is USD, and the bid price is 1.4527, meaning you can sell one us dollar for 1.4527 swiss francs. In cfd trading, the bid also represents the price at which a trader can sell the product.

BIG FIGURE

Refers to the first three digits of a currency quote, such as 114 USD/JPY or 1.16 in EUR/USD. If the price moves by 1.5 big figures, it has moved 150 pips.

BIS

The bank for international settlements located in basel, switzerland, is the central bank for central banks. The bis frequently acts as the market intermediary between national central banks and the market. The bis has become increasingly active as central banks have increased their currency reserve management. When the bis is reported to be buying or selling at a level, it is usually for a central bank and thus the amounts can be large. The bis is used to avoid markets mistaking buying or selling interest for official government intervention.

BLACK BOX

The term used for systematic, model-based or technical traders.

BLOW OFF

The upside equivalent of capitulation. When shorts throw in the towel and cover any remaining short positions.

BOLLINGER BANDS

A tool used by technical analysts. A band plotted two standard deviations on either side of a simple moving average, which often indicates support and resistance levels.

BOND

A name for debt which is issued for a specified period of time.

BOOK

In a professional trading environment, a book is the summary of a trader’s or desk’s total positions.

BRETTON WOODS AGREEMENT

In 1944, representatives from 44 allied nations met in the town of bretton woods, new hampshire usa, to discuss monetary policies in order to rebuild the international economic system. The delegates agreed to tie their currencies to gold and the us dollar and maintain an exchange rate within a parity band of 1%.

BROKER

An individual or firm that acts as an intermediary, bringing buyers and sellers together for a fee or commission. In contrast, a dealer commits capital and takes one side of a position, hoping to earn a spread (profit) by closing out the position in a subsequent trade with another party.

BUCK

Market slang for one million units of a dollar-based currency pair, or for the us dollar in general.

BULLISH/BULL MARKET

Favoring a strengthening market and rising prices. For example, “we are bullish EUR/USD” means that we think the EURO will strengthen against the dollar.

BULLS

Traders who expect prices to rise and who may be holding long positions.

BUY

Taking a long position on a product.

BUY DIPS

Looking to buy 20-30-pip/point pullbacks in the course of an intra-day trend.

C

CABLE

The GBP/USD (great british pound/u.s. dollar) pair. Cable earned its nickname because the rate was originally transmitted to the us via a transatlantic cable beginning in the mid 1800s when the GBP was the currency of international trade.

CALL OPTION

A currency trade which exploits the interest rate difference between two countries. By selling a currency with a low rate of interest and buying a currency with a high rate of interest, the trader will receive the interest difference between the two countries while this trade is open.

CANDLESTICK CHART

A chart that indicates the trading range for the day as well as the opening and closing price. If the open price is higher than the close price, the rectangle between the open and close price is shaded. If the close price is higher than the open price, that area of the chart is not shaded.

CAP

An option agreement that puts an upper limit on interest rates. A cap provides borrowers interest rate risk protection in case of floating rate loans. The borrower is compensated for any rise in the rate, beyond the cap. Caps allow borrowers to take advantage of falling rates but do not expose them to high rates.

CAPITULATION

A point at the end of an extreme trend when traders who are holding losing positions exit those positions. This usually signals that the expected reversal is just around the corner.

CARRY TRADE

A trading strategy that captures the difference in the interest rates earned from being long a currency that pays a relatively high interest rate and short another currency that pays a lower interest rate. For example: NZD/JPY (new zealand dollar/japanese yen) has been a famous carry trade for some time. NZD is the high yielder and JPY is the low yielder. Traders looking to take advantage of this interest rate differential would buy NZD and sell JPY, or be long NZD/JPY. When NZD/JPY begins to downtrend for an extended period of time, most likely due to a change in interest rates, the carry trade is said to be unwinding.

CASH MARKET

The market in the actual underlying markets on which a derivatives contract is based.

CASH PRICE

The price of a product for instant delivery; i.e., the price of a product at that moment in time.

CHARTIST

An individual, also known as a technical trader, who uses charts and graphs and interprets historical data to find trends and predict future movements.

CHOPPY

Short-lived price moves with limited follow-through that are not conducive to aggressive trading.

CLEARED FUNDS

Funds that are freely available, sent in to settle a trade.

CLEARING

The process of settling a trade.

CLOSED POSITION

Exposure to a financial contract, such as currency, that no longer exists. A position is closed by placing an equal and opposite deal to offset the open position. Once closed, a position is considered squared.

CLOSING

The process of stopping (closing) a live trade by executing a trade that is the exact opposite of the open trade.

CLOSING PRICE

The price at which a product was traded to close a position. It can also refer to the price of the last transaction in a day trading session.

COLLATERAL

An asset given to secure a loan or as a guarantee of performance.

COMMISSION

A fee that is charged for buying or selling a product.

COMMODITY CURRENCIES

Currencies from economies whose exports are heavily based in natural resources, often specifically referring to canada, new zealand, australia and russia.

COMPONENTS

The dollar pairs that make up the crosses (i.e., EUR/USD + USD/JPY are the components of EUR/JPY). Selling the cross through the components refers to selling the dollar pairs in alternating fashion to create a cross position.

CONFIRMATION

A document exchanged by counterparts to a transaction that states the terms of said transaction.

CONSOLIDATION

A period of range-bound activity after an extended price move.

CONTAGION

The tendency of an economic crisis to spread from one market to another.

CONTRACT

The standard unit of forex trading.

CONTRACT NOTE

A confirmation sent that outlines the exact details of the trade.

CONTRACT SIZE

The notional number of shares one cfd represents.

CONTROLLED RISK

A position which has a limited risk because of a guaranteed stop.*

CORPORATE ACTION

An event that changes the equity structure (and usually share price) of a stock. For example, acquisitions, dividends, mergers, splits and spinoffs are all corporate actions.

CORPORATES

Refers to corporations in the market for hedging or financial management purposes. Corporates are not always as price sensitive as speculative funds and their interest can be very long term in nature, making corporate interest less valuable to short-term trading.

COUNTER CURRENCY

The second listed currency in a currency pair.

COUNTERPARTY

One of the participants in a financial transaction.

COUNTER PARTY RISK

The risk that a party in a transaction is exposed to, arising from the possibility that the counter party may default or fail to deliver his or her obligation.

COVERED INTEREST ARBITRAGE

The process of borrowing in one currency, converting it to another currency at spot, where it is invested, and selling this second currency forward against the initial currency. A market player does this series of transactions, with the aim of making riskless profits from discrepancies between interest differentials and the percentage discount or premium between currencies, in the forward transaction.

COUNTRY RISK

Risk associated with a cross-border transaction, including but not limited to legal and political conditions.

CPI

Acronym for consumer price index, a measure of inflation.

CREDIT RISK

The risk that a counter-party may not meet his/her obligation in a contract. Same as counter-party risk

CROSS

A pair of currencies that does not include the u.s. dollar.

CROSS RATE

A cross currency rate is an exchange rate between two currencies, neither of which is the USD. For e.g. EUR/JPY, GBP/CHF. In the indian forex market, the cross rate is loosely referred to the rate for any currency pair which excludes the indian rupee. For e.g. USD/JPY

CROWN CURRENCIES

Refers to cad (canadian dollar), aussie (australian dollar), sterling (british pound) and kiwi (new zealand dollar) – countries off the commonwealth.

CURRENCY

Any form of money issued by a government or central bank and used as legal tender and a basis for trade.

CURRENCY OPTION

A currency option gives the buyer, the right but not the obligation, to buy or sell, a specific amount of currency at a specified exchange rate, on or before a future date.

CURRENCY PAIR

The two currencies that make up a foreign exchange rate. For example EUR/USD (EURo/u.s. dollar).

CURRENCY RISK

The probability of an adverse change in exchange rates.

CURRENCY SYMBOLS

A three-letter symbol that represents a specific currency. For example, USD (u.s. dollar).

D

DAY TRADER

Speculators who take positions in commodities and then liquidate those positions prior to the close of the same trading day.

DAY TRADING

Making an open and close trade in the same product in one day.

DEAL

A term that denotes a trade done at the current market price. It is a live trade as opposed to an order.

DEALER

An individual or firm that acts as a principal or counterpart to a transaction. Principals take one side of a position, hoping to earn a spread (profit) by closing out the position in a subsequent trade with another party. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission.

DEALING SPREAD

The difference between the buying and selling price of a contract.

DEFEND A LEVEL

Action taken by a trader, or group of traders, to prevent a product from trading at a certain price or price zone, usually because they hold a vested interest in doing so, such as a barrier option.

DEFICIT

A negative balance of trade or payments.

DELISTING

Removing a stock’s listing on an exchange.

DELIVERY

A trade where both sides make and take actual delivery of the product traded.

DELTA

The ratio between the change in price of a product and the change in price of its underlying market.

DEPRECIATION

The decrease in value of an asset over time.

DERIVATIVE

A financial contract whose value is based on the value of an underlying asset. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies.

DEVALUATION

When a pegged currency is allowed to weaken or depreciate based on official actions; the opposite of a revaluation.

DISCOUNT RATE

Interest rate that an eligible depository institution is charged to borrow short-term funds directly from the federal reserve bank.

DIRECT RATE

An exchange rate quote in which one unit of foreign currency is quoted in terms of x units of home currency. In india the USD/inr is a direct quote. $1 = rs. 64.60

DIRTY FLOAT

A floating currency which is regularly subject to intervention, usually by the central bank, and therefore does not freely respond to market pressures.

DIVERGENCE

In technical analysis, a situation where price and momentum move in opposite directions, such as prices rising while momentum is falling. Divergence is considered either positive (bullish) or negative (bearish); both kinds of divergence signal major shifts in price direction. Positive/bullish divergence occurs when the price of a security makes a new low while the momentum indicator starts to climb upward. Negative/bearish divergence happens when the price of the security makes a new high, but the indicator fails to do the same and instead moves lower. Divergences frequently occur in extended price moves and frequently resolve with the price reversing direction to follow the momentum indicator.

DOUBLE CROSSOVER

The use of two moving averages to generate trading signals. A buy signal is generated when the shorter moving average crosses above the longer moving average. A sell signal is generated when the shorter moving average crosses below the longer moving average.

DOWN-AND-IN OPTION

An option which comes into existence only when the price of the underlying security moves below a predefined level.

DOWN-AND-OUT OPTION

An option that expires if the price of the underlying moves below a predefined level.

DOVE

Dovish refers to data or a policy view that suggests easier monetary policy or lower interest rates. The opposite of hawkish.

DOWNTREND

Price action consisting of lower lows and lower highs.

E

EARLY EXERCISE

The exercise of an american style option before its expiry date.

EURO MARKET

A collective term used to describe a series of offshore money and capital market operations of the international bankers. EURo market comprises of EURO currency, EURO credit and EURO bond markets. The predominant centre of these markets is london except for the EURo sterling market, which is centred in Paris.

EUROCURRENCY

A currency borrowed or deposited outside the country of origin or the home country. A us dollar deposit outside the us is called a EURodollar deposit while sterling deposit held outside uk would be eurosterling deposit. eurocurrency is different from the EURO, the common currency of the EURozone and the latest currency in the international foreign exchange markets.

EUROPEAN OPTION

An option that can be exercised only on the date of expiry and not prior to that.

EXCHANGE CONTROL

Monetary authority’s rules and regulations used to protect or preserve the value of any country’s currency. These rules may restrict imports, investments abroad, travel, or other activities involving foreign exchange transaction.

EXCHANGE RATE FUTURES

A futures contract for currencies. Also see futures.

EXCHANGE RATE RISK

Risk arising from the possibility of adverse movement in the exchange rates.

EXCHANGE RATE

It is the rate of conversion of one currency into another. The number of units of one currency expressed in terms of a unit of another currency.

EXCHANGE TRADED CONTRACT (ETC)

A generic term used to describe all the derivative instruments that are traded on the floor of an organized exchange.

EXPOSURE

In foreign exchange related transactions, the potential gain or loss, because of movements in foreign exchange rates. There are three types of exposure –transaction, translation and economic.

ECONOMIC INDICATOR

A government-issued statistic that indicates current economic growth and stability. Common indicators include employment rates, gross domestic product (gdp), inflation, retail sales, etc.

END OF DAY ORDER (EOD)

An order to buy or sell at a specified price that remains open until the end of the trading day, typically at 5pm/17:00 new york time.

EXPIRY DATE/PRICE

The precise date and time when an option will expire. The two most common option expiries are 10:00am et (also referred to as 10:00 ny time or ny cut) and 3:00pm tokyo time (also referred to as 15:00 tokyo time or tokyo cut). These time periods frequently see an increase in activity as option hedges unwind in the spot market.

EXPORTERS

Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. Frequently refers to major japanese corporations such as sony and toyota, who will be natural sellers of USD/JPY, exchanging dollars received from commercial sales abroad.

EXTENDED

A market that is thought to have traveled too far, too fast.

F

FED FUNDS RATE (FEDERAL FUND RATE)

It is the overnight rate of interest at which fed funds are traded among financial institutions. Fed funds are non-interest bearing deposits held by member banks with the federal reserve. It is regarded as a key indicator of all us domestic interest rates.

FIXED EXCHANGE RATE

When the value of a currency is fixed against another major currency, such as us dollar, EURo etc., the exchange rate is said to be fixed or pegged. Fluctuations in the exchange rate around this parity are managed by official intervention and by internal regulations limiting exchange transactions. In most cases, there is a narrow band of 1 or 2%, within which the exchange rate is allowed to fluctuate on either side of the fixed rate. Eg: malaysian ringgit, chinese yuan and the saudi riyal. Also called pegged exchange rate.

FIXED-DATE FORWARD

Forward contract where delivery must occur on a single day as opposed to delivery within an option period.

FLOATING EXCHANGE RATE

When exchange rate is not fixed by the government but fluctuates depending on the demand and supply of the currencies in the market.

FLOATING RATE LOAN

Loans on which the interest rates are periodically reset. In the international financial markets, the libor related loans are the most common of the floating rate loans.

FLOOR

An option agreement that puts a lower limit on the interest rate .it provides lenders/investors with interest rate risk protection in case the rate goes below the floor rate. The lender/investor is compensated for any fall in rate below the floor rate.

FOREIGN CURRENCY RESERVES (FOREX RESERVES)

The official foreign currency reserves maintained by the central bank of a country. The reserves are used to meet current and other liabilities of a country. The central bank could use these reserves for intervention purposes also.

FORWARD CONTRACT

An agreement between two parties to exchange a specific amount of a currency at a specific date/period in the future. The rate at which the exchange is to be made, the delivery date/period and the amounts involved are fixed at the time of the agreement.

FORWARD RATE

The rate quoted today for delivery of a specified amount of currency on a specific date/period in the future.

FUNDAMENTAL ANALYSIS

A branch of analysing future price trends based on the study of economic factors affecting demand and supply of the underlying. Also see technical analysis.

FUTURES

Any contract to buy or sell a standard financial instrument, currency or index, at a predetermined future date and at a price agreed through a transaction on an exchange.

FIGURE/THE FIGURE

Refers to the price quotation of ’00’ in a price such as 00-03 (1.2600-03) and would be read as ‘figure-three.’ if someone sells at 1.2600, traders would say ‘the figure was given’ or ‘the figure was hit.

FILL

When an order has been fully executed.

FILL OR KILL

An order that, if it cannot be filled in its entirety, will be cancelled.

FIRST IN FIRST OUT (FIFO)

All positions opened within a particular currency pair are liquidated in the order in which they were originally opened.

FIX

One of approximately five times during the forex trading day when a large amount of currency must be bought or sold to fill a commercial customer’s orders. Typically these times are associated with market volatility. The regular fixes are as follows (all times ny):

5:00am – frankfurt

6:00am – london

10:00am – wmhco (world market house company)

11:00am – wmhco (world market house company) – more important

8:20am – imm

8:15am – ecb

FLAT/SQUARE

Dealer jargon used to describe a position that has been completely reversed, e.g. You bought $500,000 and then sold $500,000, thereby creating a neutral (flat) position.

FOLLOW-THROUGH

Fresh buying or selling interest after a directional break of a particular price level. The lack of follow-through usually indicates a directional move will not be sustained and may reverse.

FOREIGN EXCHANGE/FOREX/FX

The simultaneous buying of one currency and selling of another. The global market for such transactions is referred to as the forex or fx market.

FORWARD

The pre-specified exchange rate for a foreign exchange contract settling at some agreed future date, based on the interest rate differential between the two currencies involved.

FORWARD POINTS

The pips added to or subtracted from the current exchange rate in order to calculate a forward price.

FUNDAMENTAL ANALYSIS

The assessment of all information available on a tradable product to determine its future outlook and therefore predict where the price is heading. Often non-measurable and subjective assessments, as well as quantifiable measurements, are made in fundamental analysis.

FUNDS

Refers to hedge fund types active in the market. Also used as another term for the USD/cad (u.s. dollar/canadian dollar) pair.

FUTURE

An agreement between two parties to execute a transaction at a specified time in the future when the price is agreed in the present.

FUTURES CONTRACT

An obligation to exchange a good or instrument at a set price and specified quantity grade at a future date. The primary difference between a future and a forward is that futures are typically traded over an exchange (exchange- traded contacts – etc), versus forwards, which are considered over the counter (otc) contracts. An otc is any contract not traded on an exchange.

G

GAP/GAPPING

A quick market move in which prices skip several levels without any trades occurring. Gaps usually follow economic data or news announcements.

GEARING (ALSO KNOWN AS LEVERAGE)

Gearing refers to trading a notional value that is greater than the amount of capital a trader is required to hold in his or her trading account. It is expressed as a percentage or a fraction.

GIVEN

Refers to a bid being hit or selling interest.

GOING LONG

The purchase of a stock, commodity or currency for investment or speculation – with the expectation of the price increasing.

GOING SHORT

The selling of a currency or product not owned by the seller – with the expectation of the price decreasing.

GOLD (GOLD’S RELATIONSHIP)

It is commonly accepted that gold moves in the opposite direction of the us dollar. The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable.

GOLD CERTIFICATE

A certificate of ownership that gold investors use to purchase and sell the commodity instead of dealing with transfer and storage of the physical gold itself.

GOLD CONTRACT

The standard unit of trading gold is one contract which is equal to 10 troy ounces.

GOOD FOR DAY

An order that will expire at the end of the day if it is not filled.

GUARANTEED ORDER

An order type that protects a trader against the market gapping. It guarantees to fill your order at the price asked.

GUARANTEED STOP

A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point. It is guaranteed even if there’s gapping in the market.

GUNNING/GUNNED

Refers to traders pushing to trigger known stops or technical levels in the market.

H

HANDLE

Every 100 pips in the fx market starting with 000.

HAWK/HAWKISH

A country’s monetary policymakers are referred to as hawkish when they believe that higher interest rates are needed, usually to combat inflation or restrain rapid economic growth or both.

HEDGE

A position or combination of positions that reduces the risk of your primary position.

HEDGE FUND

The collective investment fund that takes large and often leveraged risk, with the aim of earning high return.

HEDGE RATIO

The percentage/portion of cover taken, in relation to the total exposure.

HEDGER

A person who uses hedging instruments to protect his exposures is called a hedger.

HISTORIC VOLATILITY

The volatility for a particular time period measured from past behaviour. This is done by means of standard deviation of a sample of daily movements. Historical volatility may not be a true indicator of the future behaviour of price.

HIT THE BID

To sell at the current market bid

I

IMPLIED VOLATILITY

The volatility derived from actual price quoted in the market. Given the quoted price, the volatility is obtained by working the model backward.

INFLATION

An economic condition whereby prices for consumer goods rise, eroding purchasing power.

INTERBANK RATES

The foreign exchange rates which large international banks quote to each other.

INITIAL MARGIN

The amount of cash or security that has to be kept by a party in a clearinghouse before entering into an options or futures contract. It is an estimated amount that would help the clearing member to meet its obligations in the event of default by the party in question.

INTEREST RATE PARITY THEOREM

The theorem holds that under normal conditions, the difference between the forward exchange rate and spot rate of a currency pair depends on the difference between the interest rates of the currencies. For e.g. If the 6 month interest rate in the us is 6.5% and that for swiss franc is 3.5%, the us dollar six month forward rate against the swiss franc will be at a discount of 3% (6.5 – 3.5) on the spot $/CHF rate.

INTERVENTION

Action by a central bank to affect the value of its currency by entering the market. Concerted intervention refers to action by a number of central banks to control exchange rates.

IN-THE-MONEY OPTION

An option whose strike price is favorable in comparison to the current price. Eg: a yen call option at 110 strike when the current price is 108.00 or a EURo call option at 0.8200 strike when the current price is .8500

INTRINSIC VALUE

The positive difference between the strike price and the current market price of an option is the intrinsic value of the option. It is measured by the present value of the amount by which it is in the money.

INVESTOR

Investors are those who purchase financial instruments with a long-term objective of earning a profit. An investor is different from a speculator who enters the market with the sole objective of making quick, short-term profits.

K

KEEP THE POWDER DRY

To limit your trades due to inclement trading conditions. In either choppy or extremely narrow markets, it may be better to stay on the sidelines until a clear opportunity arises.

KNOCK-IN OPTION

Option strategy that requires the underlying product to trade at a certain price before a previously bought option becomes active. Knock-ins are used to reduce premium costs of the underlying option and can trigger hedging activities once an option is activated.

KNOCK-OUT OPTION

Option that nullifies a previously bought option if the underlying product trades a certain level. When a knock-out level is traded, the underlying option ceases to exist and any hedging may have to be unwound.

L

LEADING INDICATORS

Statistics that are considered to predict future economic activity.

LEVEL

A price zone or particular price that is significant from a technical standpoint or based on reported orders/option interest.

LEVERAGE

Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available. It allows traders to trade notional values far higher than the capital they have. For example, leverage of 100:1 means you can trade a notional value 100 times greater than the capital in your trading account.*

LEVERAGED NAMES

Short-term traders, referring largely to the hedge fund community.

LIBID

London interbank bid rate. It is the rate at which prime banks bid for funds. It can also be described as the rate at which prime banks can place money.

LIBOR

The london inter-bank offered rate. Banks use libor as a base rate for international lending.

LIMEAN

The mean of the libor and libid of a currency for a particular period.

LIABILITY

Potential loss, debt or financial obligation.

LIMITS/LIMIT ORDER

An order that seeks to buy at lower levels than the current market or sell at higher levels than the current market. A limit order sets restrictions on the maximum price to be paid or the minimum price to be received. As an example, if the current price of USD/JPY is 117.00/05, then a limit order to buy USD would be at a price below the current market, e.g. 116.50.

LIQUID MARKET

A market which has sufficient numbers of buyers and sellers for the price to move in a smooth manner.

LIQUIDATION

The closing of an existing position through the execution of an offsetting transaction.

LONG POSITION

A position that appreciates in value if market price increases. When the base currency in the pair is bought, the position is said to be long. This Position is taken with the expectation that the market will rise.

LONGS

Traders who have bought a product.

LOT

A unit to measure the amount of the deal. The value of the deal always corresponds to an integer number of lots.

M

MARKET LOT

The standard amount for which prices are quoted in the inter-bank market.

MARKET MAKER

An entity who makes the two-way quotes providing both a bid and an offer in the market.

MARK-TO-MARKET

The valuation of the portfolio with reference to the current market prices.

MATURITY

The date on which a contract is due to be settled.

MONEY MARKET

Money market is the market for dealing in monetary assets of short term nature., short-term being referred to tenor of remaining maturity of less than one year. Money market instruments include call money, term money, certificates of deposit, commercial paper and money market mutual funds.

MACRO

The longest-term trader who bases their trade decisions on fundamental analysis. A macro trade’s holding period can last anywhere from around six months to multiple years.

MARGIN CALL

A request from a broker or dealer for additional funds or other collateral on a position that has moved against the customer.

MARKET MAKER

A dealer who regularly quotes both bid and ask prices and is ready to make a two-sided market for any financial product.

MARKET ORDER

An order to buy or sell at the current price.

MARKET-TO-MARKET

Process of re-evaluating all open positions in light of current market prices. These new values then determine margin requirements.

MATURITY

The date of settlement or expiry of a financial product.

MEDLEY REPORT

Refers to medley global advisors, a market consultancy that maintains close contacts with central bank and government officials around the world. Their reports can frequently move the currency market as they purport to have inside information from policy makers. The accuracy of the reports has fluctuated over time, but the market still pays attention to them in the short-run.

MODELS

Synonymous with black box. Systems that automatically buy and sell based on technical analysis or other quantitative algorithms.

MOM

Abbreviation for month-over-month, which is the change in a data series relative to the prior month’s level.

MOMENTUM

A series of technical studies (e.g. Rsi, macd, stochastics, momentum) that assesses the rate of change in prices.

MOMENTUM PLAYERS

Traders who align themselves with an intra-day trend that attempts to grab 50-100 pips.

N

NEER (Nominal effective exchange rate):

Neer is the weighted average of bilateral nominal exchange rates. It measures the appreciation/depreciation of a currency against the weighted basket of currencies whose countries are the main trading partners or competitors of the country of the currency under study. Nominal exchange rate is the actual exchange rate quote in the market at a given time.

NETTING

Calculating the net exposure of a party, by offsetting the receivables in a currency with the payables in the same currency, for the same dates.

NOSTRO ACCOUNT

A bank’s account with his correspondent banker abroad, ordinarily in the home currency of that country. E.g. An indian bank having a swiss franc account with a bank in switzerland or in any other international financial centre.

NET POSITION

The amount of currency bought or sold which has not yet been offset by opposite transactions.

NO TOUCH

An option that pays a fixed amount to the holder if the market never touches the predetermined barrier level.

O

ODD DATE FORWARD

When the forward contract is for a non-standard date. Typical standard dates are 1, 2, 3, 6 and twelve months from the spot date.

OFFER RATE

The price/rate at which the market maker is ready to sell the currency or lend money.

OFFSET

Liquidation of a long or short position by an opposite transaction. A sale transaction offsets a long position and a purchase transaction offsets a short position.

OPEN POSITION

The net amount of foreign currency payable or receivable is an open position. In case of a net payable, it is a short position, a net receivable is a long position.

OUT-OF-THE-MONEY

An option whose strike price is unfavorable in comparison to the current price. E.g. A yen put option at 110 strike when the current price is 108.00 or a EURo put option at 0.8200 strike when the current price is 0.8500

OFFER/ASK PRICE

The price at which the market is prepared to sell a product. Prices are quoted two-way as bid/offer. The offer price is also known as the ask. The ask represents the price at which a trader can buy the base currency, which is shown to the right in a currency pair. For example, in the quote USD/CHF 1.4527/32, the base currency is USD, and the ask price is 1.4532, meaning you can buy one us dollar for 1.4532 swiss francs.

In cfd trading, the ask represents the price a trader can buy the product. For example, in the quote for uk oil 111.13/111.16, the product quoted is uk oil and the ask price is £111.16 for one unit of the underlying market.*

OFFERED

If a market is said to be trading offered, it means a pair is attracting heavy selling interest, or offers.

OFFSETTING TRANSACTION

A trade that cancels or offsets some or all of the market risk of an open position.

ON TOP

Attempting to sell at the current market order price.

ONE CANCELS THE OTHER ORDER (OCO)

A designation for two orders whereby if one part of the two orders is executed, then the other is automatically cancelled.

ONE TOUCH

An option that pays a fixed amount to the holder if the market touches the predetermined barrier level.

OPEN ORDER

An order that will be executed when a market moves to its designated price. Normally associated with good ’til cancelled orders.

OPEN POSITION

An active trade with corresponding unrealized p&l, which has not been offset by an equal and opposite deal.

OPTION

A derivative which gives the right, but not the obligation, to buy or sell a product at a specific price before a specified date.

ORDER

An instruction to execute a trade.

ORDER BOOK

A system used to show market depth of traders willing to buy and sell at prices beyond the best available.

OVER THE COUNTER (OTC)

Used to describe any transaction that is not conducted via an exchange.

OVERNIGHT POSITION

A trade that remains open until the next business day.

P

PHYSICAL SETTLEMENT

In a futures contract, the actual receipt or delivery of the underlying.

PIP

The most junior digit in a currency quotation. In most currencies, it denotes the fifth decimal place.

PLAIN VANILLA

A simple derivative with standard features is termed as a plain vanilla.

PRICE RISK

The risk of adverse movements in prices.

PRIME RATE

The interest rate charged by major banks to their most creditworthy customers.

PUT OPTION

An option which gives the holder the right, but not the obligation, to sell a specific amount of foreign currency at a specific price on or before a specific maturity date.

PAID

Refers to the offer side of the market dealing.

PAIR

The forex quoting convention of matching one currency against the other.

PANELED

A very heavy round of selling.

PARABOLIC

A market that moves a great distance in a very short period of time, frequently moving in an accelerating fashion that resembles one half of a parabola. Parabolic moves can be either up or down.

PARTIAL FILL

When only part of an order has been executed.

PATIENT

Waiting for certain levels or news events to hit the market before entering a position.

PIPS

The smallest unit of price for any foreign currency, pips refer to digits added to or subtracted from the fourth decimal place, i.e. 0.0001.

POLITICAL RISK

Exposure to changes in governmental policy which may have an adverse effect on an investor’s position.

PORTFOLIO

A collection of investments owned by an entity.

POSITION

The net total holdings of a given product.

PREMIUM

The amount by which the forward or futures price exceeds the spot price.

PRICE TRANSPARENCY

Describes quotes to which every market participant has equal access.

PROFIT

The difference between the cost price and the sale price, when the sale price is higher than the cost price.

PULLBACK

The tendency of a trending market to retrace a portion of the gains before continuing in the same direction.

PUT OPTION

A product which gives the owner the right, but not the obligation, to sell it at a specified price.

Q

QUANTITATIVE EASING

When a central bank injects money into an economy with the aim of stimulating growth.

QUOTE

An indicative market price, normally used for information purposes only.

R

RATING

A grading of a security’s investment quality.

REER (Real effective exchange rate)

Reer is the nominal effective exchange rate(neer) adjusted for inflation. In other words, the reer is calculated by dividing the home country’s nominal effective exchange rate by an index of the ratio of average foreign prices to home prices. Reer may change even without any change in the exchange rate.

RECESSION

A period of decline in the overall economic activity of a country. It is measured by the decline in real gdp for two consecutive quarters.

REPO

A simultaneous sale and repurchase of a security. It is a structure devised to borrow money at fine rates on a secured basis. The institution borrows money by selling a security for one delivery date with a simultaneous repurchase of the same security for a different delivery date. Commonly, this type of transaction is used to fund bond trading activities. It is a financial tool often used by central banks in their open market operations to drain liquidity from the system.

REVERSE REPO

The transaction undertaken by the counterparty to a repo. It involves the purchase of security for a particular delivery date with a simultaneous sale of the same security for a different delivery date. Central banks use this to pump liquidity into the system.

RALLY

A recovery in price after a period of decline.

RANGE

When a price is trading between a defined high and low, moving within these two boundaries without breaking out from them.

RATE

The price of one currency in terms of another, typically used for dealing purposes.

REAL MONEY

Traders of significant size including pension funds, asset managers, insurance companies, etc. They are viewed as indicators of major long-term market interest, as opposed to shorter-term, intra-day speculators.

REALIZED PROFIT/LOSS

The amount of money you have made or lost when a position has been closed.

RESISTENCE LEVEL

A price that may act as a ceiling. The opposite of support.

RETAIL INVESTOR

An individual investor who trades with money from personal wealth, rather than on behalf of an institution.

REVALUATION

When a pegged currency is allowed to strengthen or rise as a result of official actions; the opposite of a Devaluation.

RIGHTS ISSUE

A form of corporate action where shareholders are given rights to purchase more stock. Normally issued by companies in an attempt to raise capital.

RISK

Exposure to uncertain change, most often used with a negative connotation of adverse change.

RISK MANAGEMENT

The employment of financial analysis and trading techniques to reduce and/or control exposure to various types of risk.

ROLLOVER

A rollover is the simultaneous closing of an open position for today’s value date and the opening of the same position for the next day’s value date at a price reflecting the interest rate differential between the two currencies.

In the spot forex market, trades must be settled in two business days. For example, if a trader sells 100,000 EURos on tuesday, then the trader must deliver 100,000 EURos on thursday, unless the position is rolled over. As a service to customers, all open forex positions at the end of the day (5:00 pm new york time) are automatically rolled over to the next settlement date. The rollover (or swap) adjustment is simply the accounting of the cost-of-carry on a day-to-day basis. Learn more about forex.com’s rollover policy

ROUND TRIP

A trade that has been opened and subsequently closed by an equal and opposite deal.

RUNNING PROFIT/LOSS

An indicator of the status of your open positions; that is, unrealized money that you would gain or lose should you close all your open positions at that point in time.

S

SPECULATOR

A person who buys and sells in a market with the sole aim of profiting from the subsequent price movements.

Sterilization: the process followed by a central bank to increase or decrease the money supply in order to offset a money-supply change caused by intervention in the foreign exchange market.

SECTOR

A group of securities that operate in a similar industry.

SELL

Taking a short position in expectation that the market is going to go down.

SETTLEMENT

The process by which a trade is entered into the books, recording the counterparts to a transaction. The settlement of currency trades may or may not involve the actual physical exchange of one currency for another.

SHORT-COVERING

After a decline, traders who earlier went short begin buying back.

SHORT POSITION

An investment position that benefits from a decline in market price. When the base currency in the pair is sold, the position is said to be short.

SHORT SQUEEZE

A situation in which traders are heavily positioned on the short side and a market catalyst causes them to cover (buy) in a hurry, causing a sharp price increase.

SHORTS

Traders who have sold, or shorted, a product, or those who are bearish on the market.

Sidelines, sit on hands

Traders staying out of the markets due to directionless, choppy or unclear market conditions are said to be on the sidelines or sitting on their hands.

SIMPLE MOVING AVERAGE SMA

A simple average of a pre-defined number of price bars. For example, a 50 period daily chart sma is the average closing price of the previous 50 daily closing bars. Any time interval can be applied.

SLIPPAGE

The difference between the price that was requested and the price obtained typically due to changing market conditions.

SLIPPERY

A term used when the market feels like it is ready for a quick move in any direction.

SLOPPY

Choppy trading conditions that lack any meaningful trend and/or follow-through.

SOVEREIGN NAMES

Refers to central banks active in the spot market.

SPOT MARKET

A market whereby products are traded at their market price for immediate exchange.

SPOT PRICE

The current market price. Settlement of spot transactions usually occurs within two business days.

SPOT TRADE

The purchase or sale of a product for immediate delivery (as opposed to a date in the future). Spot contracts are typically settled electronically.

SPREAD

The difference between the bid and offer prices.

SQUARE

Purchase and sales are in balance and thus the dealer has no open position.

STERLING

A nickname for the british pound or the GBP/USD (great british pound/u.s. dollar) currency pair.

STOCK EXCHANGE

A market on which securities are traded.

STOCK INDEX

The combined price of a group of stocks – expressed against a base number – to allow assessment of how the group of companies is performing relative to the past.

STOP ENTRY ORDER

This is an order placed to buy above the current price, or to sell below the current price. These orders are useful if you believe the market is heading in one direction and you have a target entry price.

STOP-LOSS HUNTING

When a market seems to be reaching for a certain level that is believed to be heavy with stops. If stops are triggered, then the price will often jump through the level as a flood of stop-loss orders are triggered.

STOP LOSS ORDER

This is an order placed to sell below the current price (to close a long position), or to buy above the current price (to close a short position). Stop loss orders are an important risk management tool. By setting stop loss orders against open positions you can limit your potential downside should the market move against you. Remember that stop orders do not guarantee your execution price – a stop order is triggered once the stop level is reached, and will be executed at the next available price.

STOP ORDER

A stop order is an order to buy or sell once a pre-defined price is reached. When the price is reached, the stop order becomes a market order and is executed at the best available price. It is important to remember that stop orders can be affected by market gaps and slippage, and will not necessarily be executed at the

Stop level if the market does not trade at this price. A stop order will be filled at the next available price once the stop level has been reached. Placing contingent orders may not necessarily limit your losses.

STOPS BUILDING

Refers to stop-loss orders building up; the accumulation of stop-loss orders to buy above the market in an upmove, or to sell below the market in a downmove.

STRIKE PRICE

The defined price at which the holder of an option can buy or sell the product.

SUPPORT

A price that acts as a floor for past or future price movements.

SUPPORT LEVELS

A technique used in technical analysis that indicates a specific price ceiling and floor at which a given exchange rate will automatically correct itself. Opposite of resistance.

SUSPENDED TRADING

A temporary halt in the trading of a product.

SWAP

A currency swap is the simultaneous sale and purchase of the same amount of a given currency at a forward exchange rate.

T

T-BILL(Treasury bill)

Short-term government debt instrument normally issued at a discount.

TREND

When the market is heading in a particular direction- up or down.

TAKEOVER

Assuming control of a company by buying its stock.

TECHNICAL ANALYSIS

The process by which charts of past price patterns are studied for clues as to the direction of future price movements.

TECHNICIANS/TECHS

Traders who base their trading decisions on technical or charts analysis.

TEN (10) YR

Us government-issued debt which is repayable in ten years. For example, a us 10-year note.

THIN

A illiquid, slippery or choppy market environment. A light-volume market that produces erratic trading conditions.

THIRTY (30) YR

Uk government-issued debt which is repayable in 30 years. For example, a uk 30-year gilt.

TICK (SIZE)

A minimum change in price, up or down.

TIME TO MATURITY

The time remaining until a contract expires.

TOMORROW NEXT (TOM/NEXT)

Simultaneous buying and selling of a currency for delivery the following day.

TAKE PROFIT

Refers to limit orders that look to sell above the level that was bought, or buy back below the level that was sold.

TRADE SIZE

The number of units of product in a contract or lot.

TRADING BID

A pair is acting strong and/or moving higher; bids keep entering the market and pushing prices up.

TRADING HALT

A postponement to trading that is not a suspension from trading.

TRADING HEAVY

A market that feels like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts.

TRADING OFFERED

A pair is acting weak and/or moving lower, and offers to sell keep coming into the market.

TRADING RANGE

The range between the highest and lowest price of a stock usually expressed with reference to a period of time. For example: 52-week trading range.

TRAILING STOP

A trailing stop allows a trade to continue to gain in value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a specified distance. Placing contingent orders may not necessarily limit your losses.

TRANSACTION COST

The cost of buying or selling a financial product.

TRANSACTION DATE

The date on which a trade occurs.

TREND

Price movement that produces a net change in value. An uptrend is identified by higher highs and higher lows. A downtrend is identified by lower highs and lower lows.

TURNOVER

The total money value or volume of all executed transactions in a given time period.

TWO-WAY PRICE

When both a bid and offer rate is quoted for a forex transaction.

U

UGLY

Describing unforgiving market conditions that can be violent and quick.

UK OIL*

A name for brent crude oil.

UNDERLYING

The actual traded market from where the price of a product is derived.

UNREALIZED GAIN/LOSS

The theoretical gain or loss on open positions valued at current market rates, as determined by the broker in its sole discretion. Unrealized gains/losses become profits/losses when the position is closed.

UPTICK

A new price quote at a price higher than the preceding quote.

UPTICK RULE

In the us, a regulation whereby a security may not be sold short unless the last trade prior to the short sale was at a price lower than the price at which the short sale is executed.

US OIL

A name for wti crude oil.

US PRIME RATE

The interest rate at which us banks will lend to their prime corporate customers.

V

VALUE DATE

The date of actual exchange of currency. It is the date on which the contract is affected. For a spot contract, the value date is the second working day from the date of the transaction.

Var

Probable worst case scenario for a position calculated using a statistical model, to a given confidence level , typically 95% over a specified holding period. Value at risk (var) is a single, summary, statistical measure that provides a reading of the worst possible scenario for a particular exposure, or set of exposures. Var is calculated by using the distribution of returns from a particular asset, finding its standard deviation (volatility), and taking certain number of standard deviations to give the 95% confidence level.

VOSTRO ACCOUNT

The local currency account of a foreign bank/branch. E.g. Indian rupee account maintained by a bank in london with a bank in india. .

VALUE DATE

Also known as the maturity date, it is the date on which counterparts to a financial transaction agree to settle their respective obligations, i.e., exchanging payments. For spot currency transactions, the value date is normally two business days forward.

VARIATION MARGIN

Funds traders must hold in their accounts to have the required margin necessary to cope with market fluctuations.

VIX OR VOLATILITY INDEX

Shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of s&p 500 index options. The vix is a widely used measure of market risk and is often referred to as the “investor fear gauge.”

VOLATILITY

Referring to active markets that often present trade opportunities.

W

WEDGE CHART PATTERN

Chart formation that shows a narrowing price range over time, where price highs in an ascending wedge decrease incrementally, or in a descending wedge, price declines are incrementally smaller. Ascending wedges typically conclude with a downside breakout and descending wedges typically terminate with upside breakouts.

WHIPSAW

Slang for a highly volatile market where a sharp price movement is quickly followed by a sharp reversal.

WHOLESALE PRICES

Measures the changes in prices paid by retailers for finished goods. Inflationary pressures typically show earlier than the headline retail.

WORKING ORDER

Where a limit order has been requested but not yet filled.

Y

YIELD CURVE

The diagrammatic representation of the yield on money market instruments and their respective maturity.

YIELD

The percentage return from an investment.

YOY

Abbreviation for year over year.

We are regulated

SEBI Registration

Registered Investment Advisor(RIA)

NISM-202100075147

Sub-Broker

AP0091502703

CIN

U65910DL2014PTC320897

Ready to start making good choices?

Receive forex updates right in your mail box or Whatsapp

We use cookies to enhance your experience on our website. By continuing to use this site, you consent to the use of cookies in accordance with our Cookie Policy. You can manage and change your cookie settings at any time.